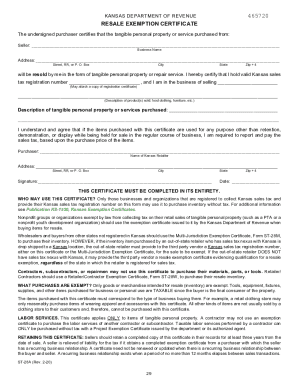

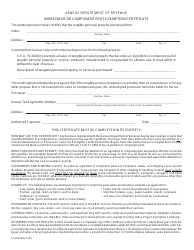

kansas sales tax exemption certificate

1320 Research Park Drive Manhattan Kansas 66502 785 564-6700 The information contained in this handbook is for informational purposes only and is to be used as a resource for commonly sought information. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

Printable Louisiana Sales Tax Exemption Certificates

File withholding and sales tax online.

. 79-3606hhhh and amendments thereto if an agricultural business. This sales tax exemption is in the Kansas Department of Revenues Notice 00-08 Kansas Exemption for Manufacturing Machinery Equipment as Expanded by KSA. How to use sales tax exemption certificates in Kansas.

This registration will furnish a business with a unique Kansas sales tax number otherwise referred to as a Kansas Tax ID number. On November 1 2014 the sales tax exemption certificate issued by the Kansas Department of Revenue will expire. The company can claim either the 15 percent credit or up to the 1125 percent whichever is less.

This project exemption certificate has been issued to a business which meets the requirements established in KSA. Tax Policy and Statistical Reports. Sellers should retain a.

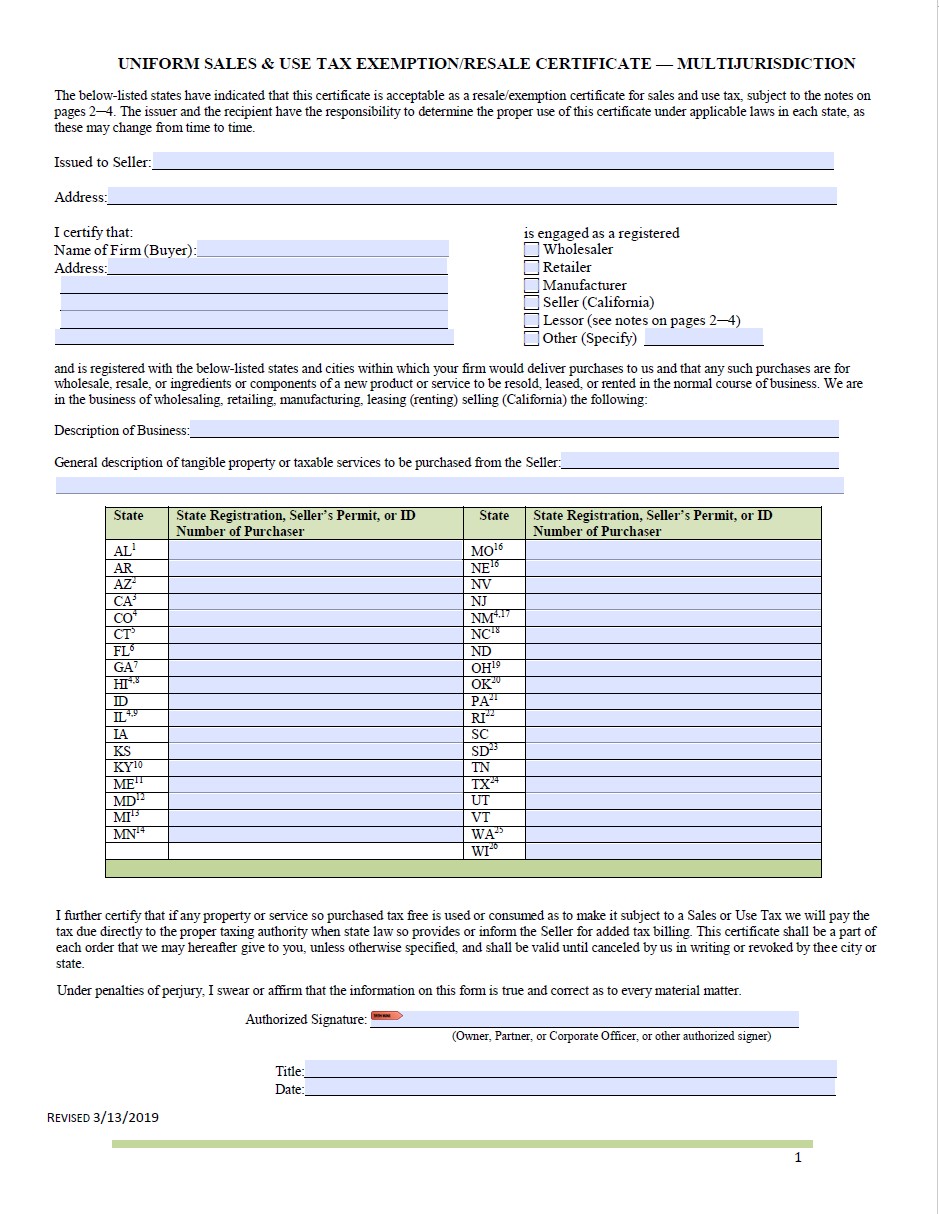

Effective July 1 2022 purchasers which includes contractors may use this certificate to purchase tangible personal property necessary to construct reconstruct repair or replace any fence used to enclose land devoted to agriculture use exempt from Kansas sales tax. For a Kansas sales tax exemption certificate to be provided to vendors for University purchases or for information regarding the Universitys sales tax exemption status in other states please contact KSU General Accounting office at 785 532-6202. Kansas location the out-of-state buyer must provide a Kansas sales tax number either on this certificate or the Multi-Jurisdiction Exemption Certificate for the sale to be exempt.

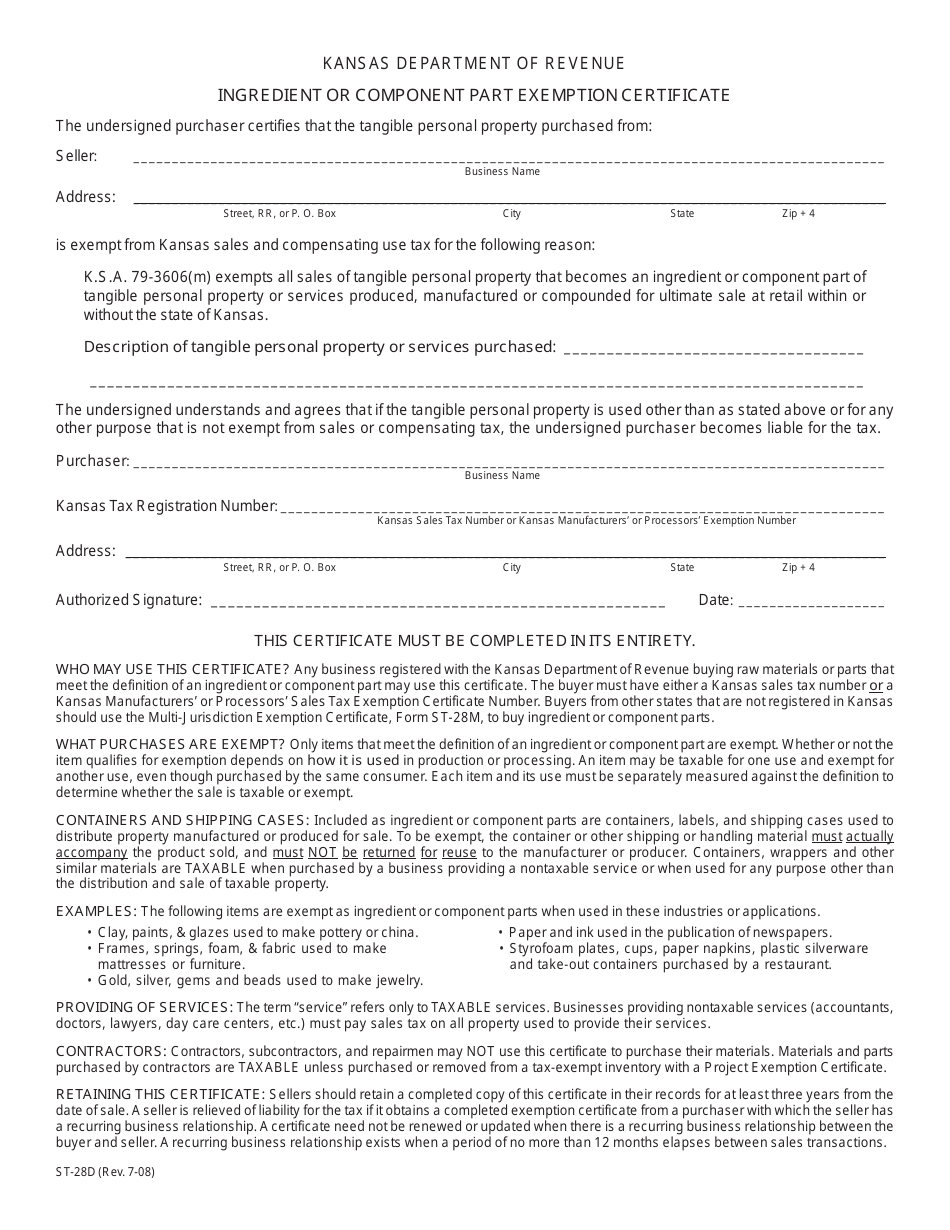

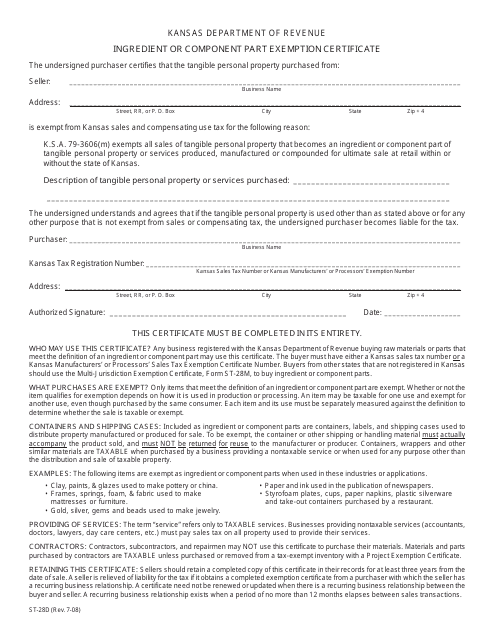

Ingredient or component part Consumed in production Propane for agricultural use The property purchased is farm or aquaculture machinery or equipment repair or replacement parts or labor services on farm or aquaculture machinery or equipment which will be used exclusively in. Local sales rates and changes. There are a few important things to note for both buyers and sellers who will use this form for tax-exempt purchases.

You can use this form to claim tax-exempt status when purchasing items. An exemption certificate is a document that a buyer presents to a retailer to claim exemption from Kansas sales or use tax. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

Enter the Confirmation Number provided on the Certificate of Tax Clearance C000-0000-0000. It shows why sales tax was not charged on a retail sale of goods or taxable services. Contractors subcontractors or repairmen may not use this certificate to purchase their materials parts or tools.

Address tax rate locator. KS Policy from 10012019 to 6302021 Remote sellers with no physical presence in Kansas are required to collect and remit the applicable sales or use tax on sales delivered into Kansas as provided under the constitution and laws of the United States. The renewal process will be available after June 16th.

A sellers permit is commonly known as a sales tax permit reseller permit resale certificate sales tax exemption certificate sales tax license or sales and use tax permit. You can download a PDF of the Kansas Streamlined Sales Tax Certificate of Exemption Form SST on this page. House Bill 2136 enacted during the 2022 Legislative Session created this Act the purpose of which is to provide financial assistance to certain businesses impacted by COVID.

RetailerContractors should use a RetailerContractor Exemption Certificate Form ST. Your Kansas Tax Registration Number. While groceries are not tax exempt any food that is used to provide meals for the elderly or homebound is considered to be exempt.

It is not intended to be comprehensive or to address all applications of the general policies or procedures described or referenced. Step 1 Begin by downloading the Kansas Resale Exemption Certificate Form ST-28A Step 2 Identify the sellers name business address Sales Tax Registration Number and a general description of what products or services the business sells Step 3 Describe the tangible personal property or services the buyer will be purchasing. Copy of prior-year tax documents.

Nonprofit youth development organization should use the exemption certificate issued to it by the Kansas Department of Revenue when buying items for resale. The new certificates have an expiration date of October 1 2020. The location of the agricultural land is the location of the land where the fence will be constructed.

Wholesalers and buyers from other states not registered in Kansas should use the Multi-Jurisdiction Exemption Certificate Form ST-28M to purchase their inventory. For other Kansas sales tax exemption certificates go here. In Kansas certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

79-3606hhhh and amendments thereto provide an exemption from all sales tax on. The Department of Revenue is in the process of developing an Informational Notice that will set forth the details of the COVID-19 Retail Storefront Property Tax Relief Act and anticipates it will be issued soon. Exemption Certificate Enter your Sales or Use Tax Registration number and the Exemption Certificate number you wish to verify.

For Project Exemption Certificates a project specific sales tax exemption number to be provided. It allows suppliers to know that you are legally allowed to purchase the goods without. All construction materials and prescription drugs including prosthetics and devices used to increase mobility are considered to be exempt.

In the state of Kansas it is formally referred to as a business registration. This notice is available by calling 785-368-8222 or from our web site. A Kansas resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to purchase goods from a supplier that are intended to be resold without the reseller having to pay sales tax on them.

74- 50115 and amendments thereto if an HPIP certified business or KSA. Make a tax payment. The certificates will need to be renewed on the departments website.

Is exempt from Kansas sales and compensating use tax for the following reason check one box. Kansas law KSA 40-252d provides for a tax credit for insurance companies equal to 15 percent of Kansas-based employees salaries or up to a maximum of 1125 percent of taxable premiums dependent on the companys affiliation. HOWEVER if the inventory item purchased by an out-of.

Remote Seller Compliance Date. Additional Remote Seller Information. This could make the effective tax rate on such.

The buyer completes and furnishes the exemption certificate and the seller keeps the certificate on file with other sales tax records. Destination-based sales tax information.

Form St 28d Download Fillable Pdf Or Fill Online Ingredient Or Component Part Exemption Certificate Kansas Templateroller

137 Printable Used Car Sale Contract Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Form St 28d Download Fillable Pdf Or Fill Online Ingredient Or Component Part Exemption Certificate Kansas Templateroller

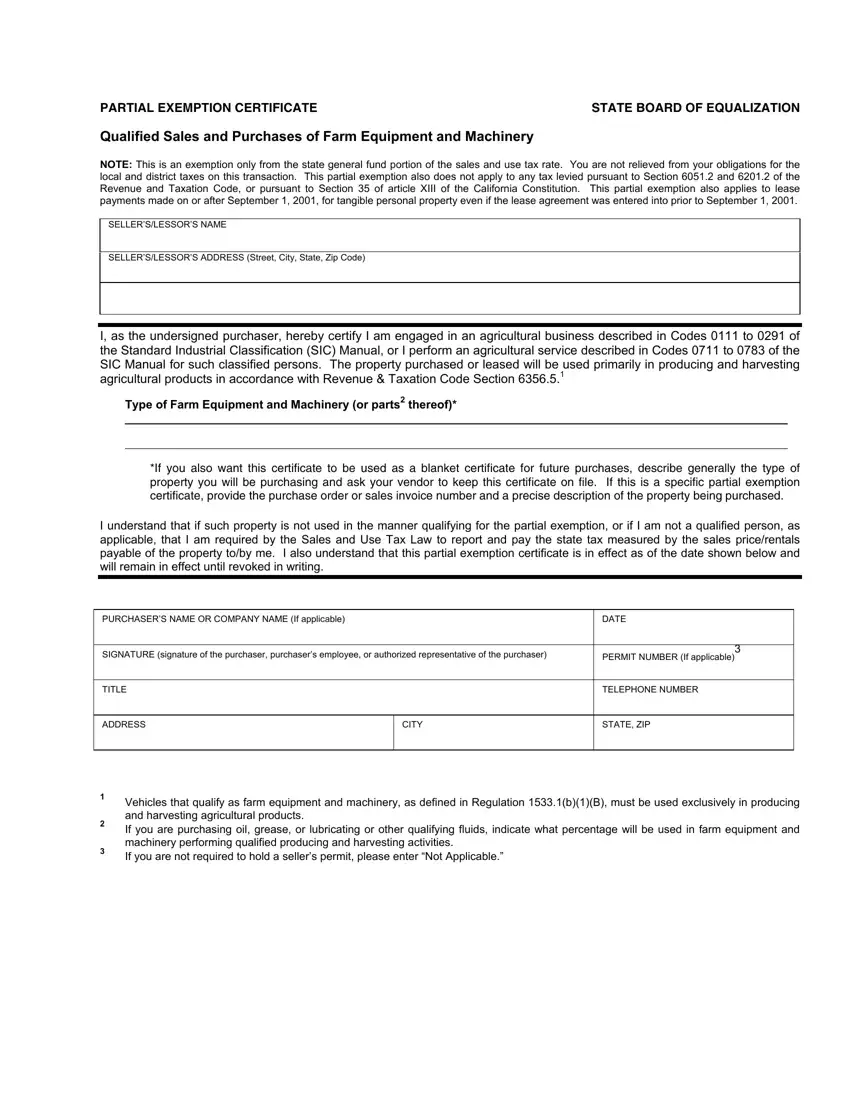

Partial Exemption Certificate Farm Fill Out Printable Pdf Forms Online

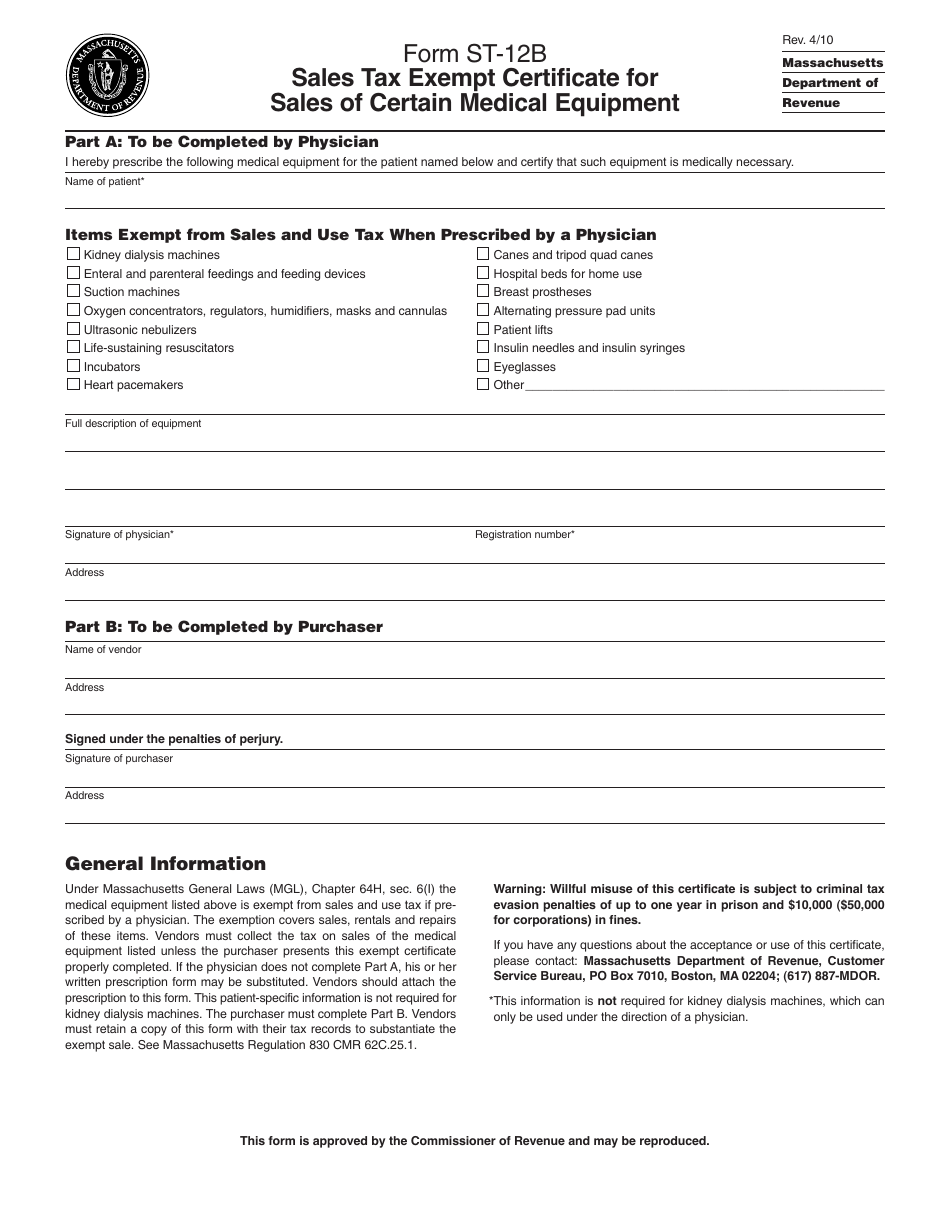

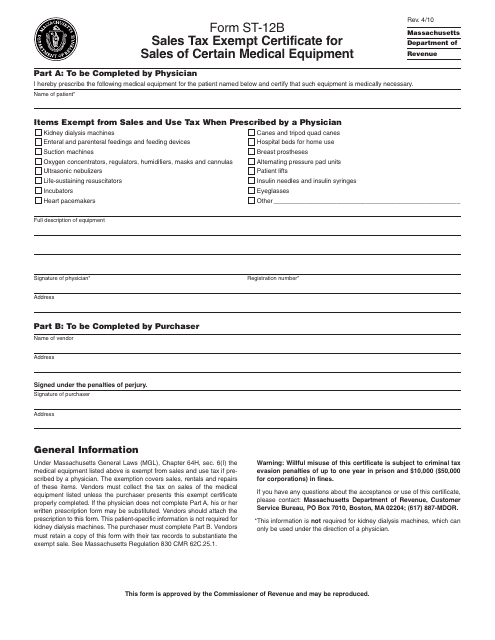

Form St 12b Download Printable Pdf Or Fill Online Sales Tax Exempt Certificate For Sales Of Certain Medical Equipment Massachusetts Templateroller

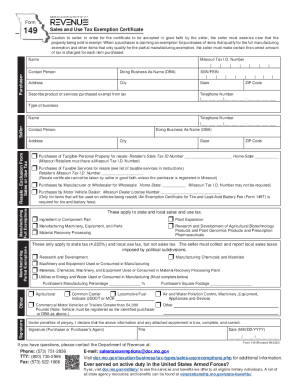

Get And Sign Dor Mo Govforms149149 Sales And Use Tax Exemption Certificate 2021 2022

Get And Sign Pub Ks 1510 Sales Tax And Compensating Use Tax Booklet Rev 12 20 This Publication Has Been Prepared By The Kansas Department Of 2020 2022 Form

How To Register For A Sales Tax Permit In Kansas Taxvalet

Form St 28d Download Fillable Pdf Or Fill Online Ingredient Or Component Part Exemption Certificate Kansas Templateroller

Fillable Online Magtek Kansas Department Of Revenue Resale Exemption Certificate The Undersigned Purchaser Certifies That The Tangible Personal Property Or Service Purchased From Magtek Fax Email Print Pdffiller

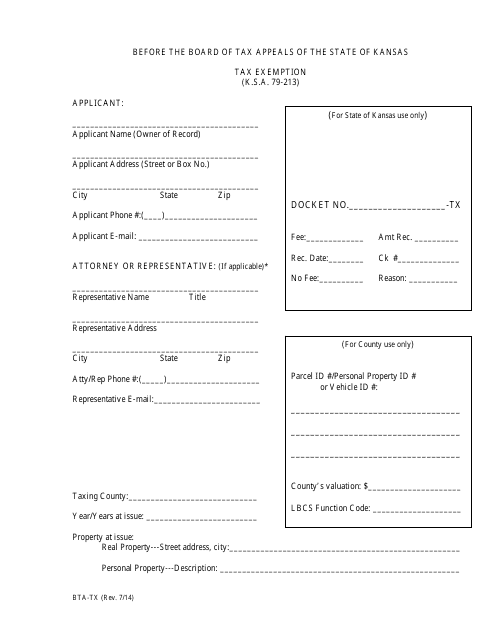

Form Bta Tx Download Fillable Pdf Or Fill Online Tax Exemption Application Kansas Templateroller

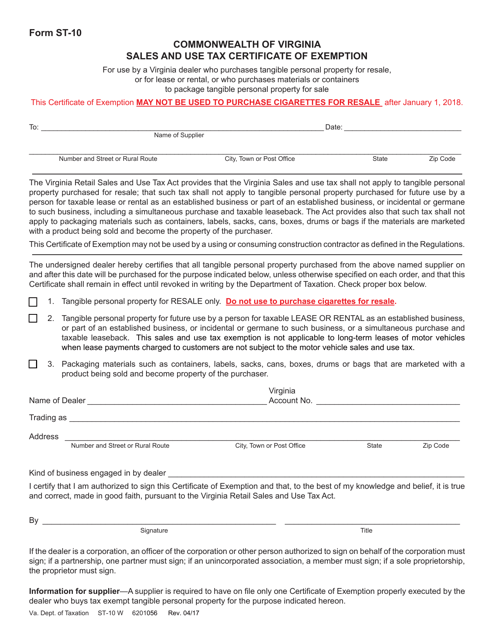

Form St 10 Download Fillable Pdf Or Fill Online Exemption Certificate For Certain Purchases By Virginia Dealers Virginia Templateroller

Form St 12b Download Printable Pdf Or Fill Online Sales Tax Exempt Certificate For Sales Of Certain Medical Equipment Massachusetts Templateroller

Kansas Sales Tax Handbook 2022

How To Get A Sales Tax Certificate Of Exemption In North Carolina

Oklahoma Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller